Pros

- Easily and securely connect to Australian banks

- Simple user interface

- Track banks details, property value, stocks and crypto

Cons

- Limited by tech for automatic tracking

- Default transaction categorisation needs work

- May not match everyone's budget

How do you manage your finances? I’ve tried alternative solutions over the years, from tracking everything in a spreadsheet to using free apps like Pocketbook to just kind of leaving it and hoping for the best.

But over the years, I’ve found that the only way to really stay on top of your financial situation is to focus on it. To track it.

This is even more true if you want to grow your wealth, and not just manage a household budget so you don’t spend more than you earn.

The sad truth is though that many of the good free apps that let you track your spending have either gone belly up or have limited features that don’t really let you do what you want.

So I’ve been keeping a bit of an eye on Gather since it soft-launched. I worked with co-founder Parth back at Finder, and have kept tabs on how the app has been rolling out.

The app has recently come out of an invite-only period, I was able to get access to the service with a free trial. It’s a slick app that offers a comprehensive suite of features, yet still feels like it has a long road of growth ahead of it.

The question is whether it’s worth the $15/month subscription fee. In my opinion, that will ultimately come down to what you want out of the app itself.

What does Gather offer?

At its core, Gather is an app that makes it easy to track your finances across multiple bank accounts and platforms. It consolidates that information into an easy to navigate and read platform.

One of the most difficult challenges with many financial apps is that they require you to manually track your spending. Sometimes that’s easy, like a regular mortgage repayment. But often it becomes more work than it’s worth, trying to keep track of every transaction across multiple accounts.

Historically, you could work around this by giving apps access to your online banking details, though obviously, there are massive risks involved with that. These apps would log in, and effectively screenshot your transaction history, then import that data into their platform.

More recently, the Consumer Data Right, or Open Banking initiative, kicked off in Australia, which now lets you give verified third parties secure access to the data of your financial accounts. It’s by far the most secure way of sharing your personal financial data, as no passwords are shared.

And this is how Gather manages its financial data collection. Gather is a Consumer Data Right (CDR) Representative, bound by the strict regulations in place to keep your information secure and private.

All of this means that to access your financial data securely through the Gather app, your financial institution needs to offer Open Banking. That’s generally fine for Australian banks – there are over 100 institutions to connect to in the Gather app.

But it also limits the tracking of other financial assets to a manual process, for now at least.

Aside from just tracking your bank balances and expenses, the Gather app lets you keep track of other assets and investments. You can keep tabs on property value, stocks, superannuation, and private investment.

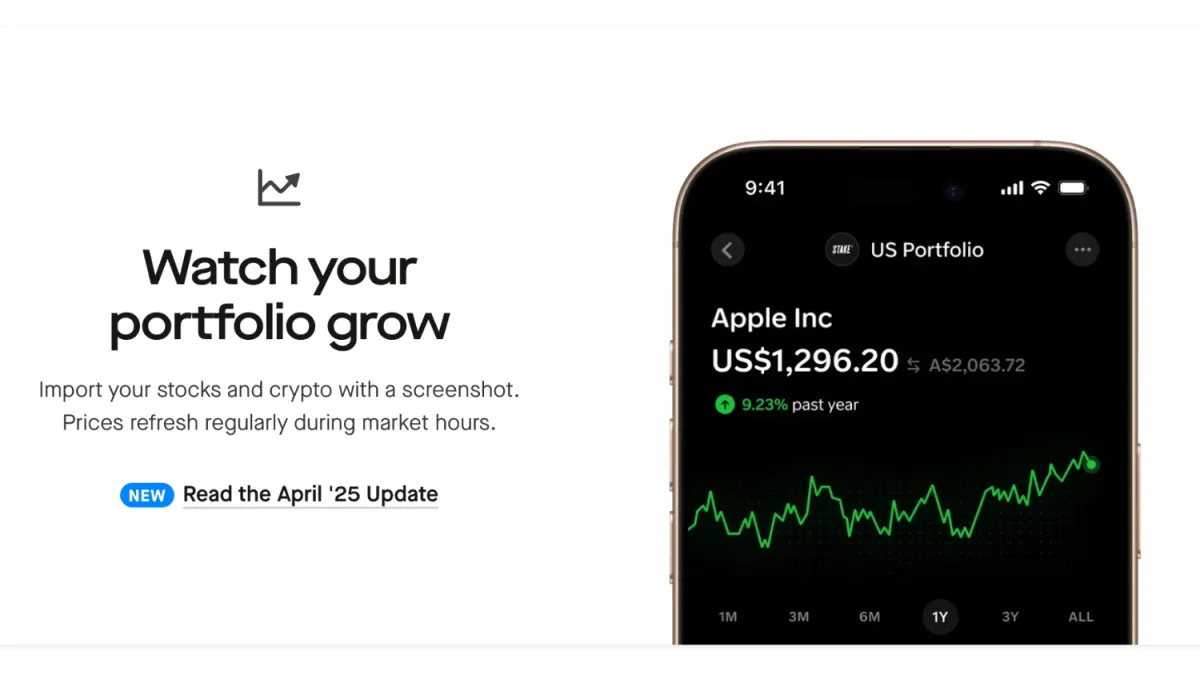

In most of these cases, the tracking is manual. But Gather does have a few tricks up its sleeve, like letting you upload screenshots of your stock portfolio transactions to add that information into your wealth tracking.

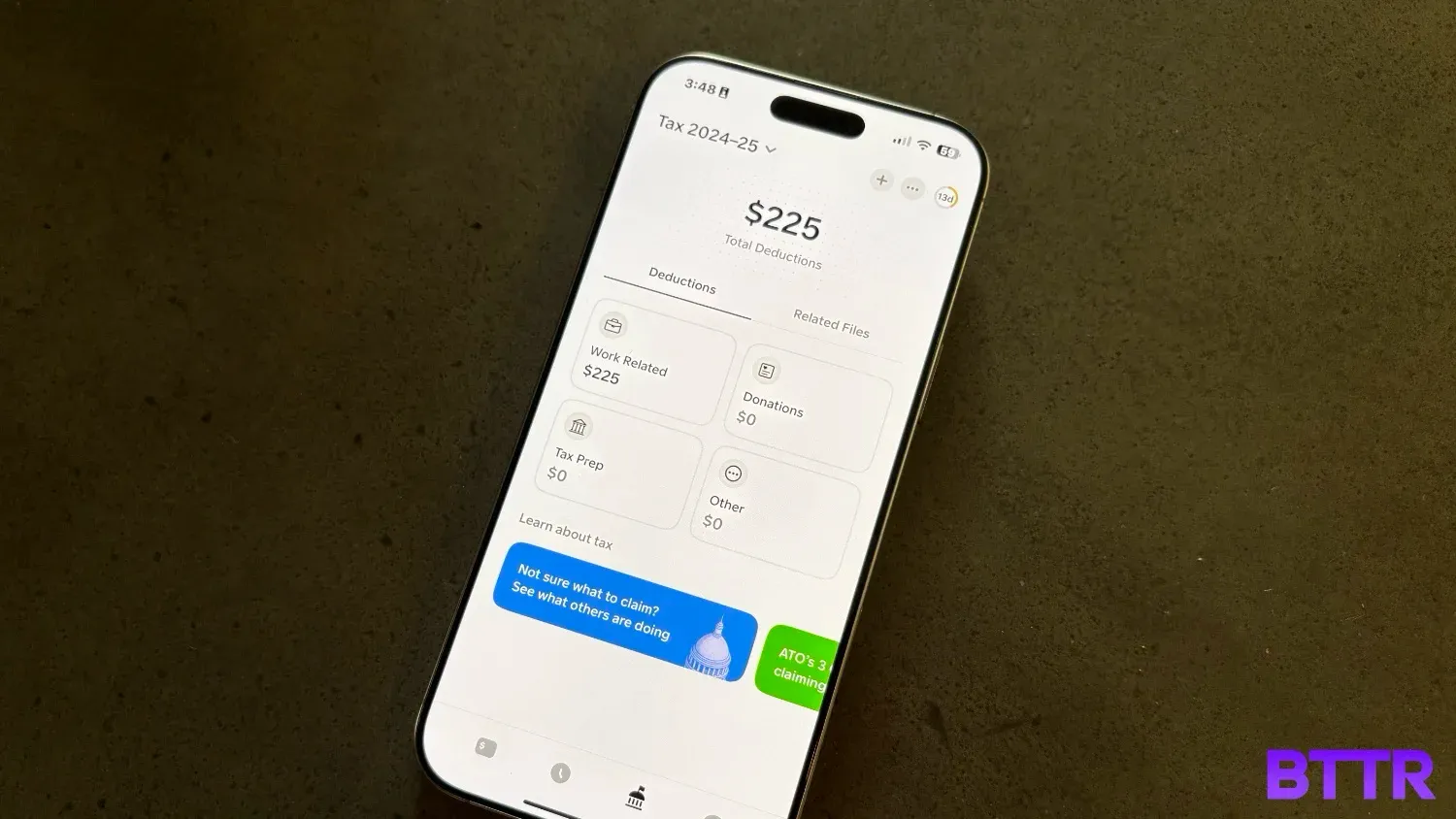

There are a few other features worth flagging as well, like the easy tax wizard that makes it easy to identify work-related expenses for your tax return.

Gather also promises to help with your energy plan to make sure you’re on the best deal, but it’s not a part of the app natively. About a week after I started using the app, I received an email offering to check for me if I replied to the email with a copy of my latest electricity or gas bill.

What does Gather do well?

Gather’s process for connecting with bank accounts is fast and efficient, and I particularly appreciate the transparency around each bank’s connectivity. Gather will tell you if there are any issues with a bank’s CDR connection, which is useful for when transactions aren’t coming through quickly.

The user interface is clean and easy to navigate, with a clear graph of your financial position at the top of the main page clearly showing your cumulative wealth over time every time you log in.

As time goes on and the app integrates more features, I think this is going to become much more important. For now, it’s nice to see, but doesn’t impact the fundamental function of the app.

What is that fundamental function, then? Currently, it is tracking your transactions across multiple accounts in a single location. There’s a lot I like here, particularly the “If this, then that” approach to recategorising your transactions.

If you have a particular type of transaction – like a regular Stripe payment for your paying subscribers, for example – you can easily set a rule that categorises those transactions as “Business income” rather than an “Internal transfer”.

It takes a bit of work to get it all categorised correctly – and this is probably something that will improve over time. But once it’s done and the rules are set you shouldn’t have to spend too much time recategorising transactions every month.

Adding stocks is also a pretty slick process. If you trade a lot you can upload a screenshot to do it automatically, but the manual process was fine for my small portfolio.

I also appreciate the connection between my property and my mortgage. Once added, I can clearly see how my loan is tracking against the property value, which gives me a view as to how much equity I have. I just wish it could track the house’s value without manual input.

What could Gather improve?

Gather isn’t officially available for everyone just yet, as the team builds up its feature set for launch. So any feedback here is likely to be addressed in the short to mid-term, maybe even before you can even sign up to the app.

The greatest challenge with Gather right now is that too much is still manual. This is not the fault of the app makers – the Australian government paused plans to roll out the CDR for superannuation, for example, so you can’t automatically connect Gather to your super fund for automatic tracking of your Super.

This means that while you can add Super manually, any changes in value, either through employer contributions or from portfolio performance, have to be made manually.

It’s the same for any property value you have in the app as well.

While the transaction categorisation is robust and easy to update, there were a couple of repetitive things that I couldn’t easily solve with rules I’d love to see updated.

The first is the standard of automatic categorisation. While Gather’s recategorisation process is straightforward, I found that more often than not, transactions were categorised incorrectly.

For a couple of months worth of data that’s manageable, but stretched out over two years, it gets tiring having to fix everything quickly.

The second was handling refunds from stores. By default, these were categorised as “Internal transfer” and excluded from tracking. I had to find them, then recategorise them (setting rules as I go). There wasn’t a “refund” category either, which would have made it all a bit easier.

The third was how the app handled “OSKO payments”. Again, the default seemed to be Internal transfer, but that was only true for some transactions between my accounts. Currently, you can only set rules around the transaction name, rather than the description you type in while making an OSKO transfer. Giving the ability to set rules with this information would simplify this hurdle.

Verdict

Gather is a slick app that promises to simplify your finances by allowing you to track everything all in one place.

It’s easy to use, with a nice level of polish and clean user interface. Connecting to bank accounts to track your money in and money out is seamless, and there are plenty of options for connecting different investments. It works well, and while there are a few teething issues, the overall experience is impressive.

But, overshadowing all the pros and cons I’ve discussed in this review is that Gather is not a free app.

It costs $14.99 per month or $9.99 a month if you pay up front for a year, a price that puts it alongside PocketSmith – a desktop only app with a much longer history.

So, is Gather worth it?

From the two weeks I’ve been using Gather, I’m convinced it will be worth that price over time. Right now, it will really depend on what you want to get out of the app.

If you’re looking for an app to easily keep track of all your finances and investments, Gather is a solid place to start.

If you’re after a budgeting app that lets you search for opportunities to reduce spending to help you get out of debt, I’m not quite sure the value is there yet. While using the app makes visibility much easier, it’s also a cost you may not be able to pay.

The good thing is that there is a five week free trial of the app before you hand over any money, which should be enough time to discover whether Gather is good for your needs.

BTTR relies on support from readers like you to keep going. If you'd like to support our work, consider a one-time donation. Every little bit helps us to cover costs and stay independent. 100% of donations go directly to authors. Thanks for your support!

UPDATE: The original version of this review stated that the app was invite-only, but it is now in public access. It also originally stated the trial period was seven days, when it is in fact five weeks.