The hardest part of keeping a budget is keeping on top of where your money is going. Over the years there have been a number of apps and services that have offered a level of finance tracking, but one by one they seem to fail.

Pocketbook was my go-to app for a while, until it closed up shop. I used Pocketsmith, but the lack of a usable mobile app (and the ongoing subscription cost) really held it back. Apps like Frollo and the Finder app have some elements I like, but ultimately left me frustrated in one way or another.

So I've been watching the launch of Gather for a while now. Like Pocketsmith, it's a paid service, but unlike Pocketsmith it's mobile first, making it a much more convenient user experience.

This week, Gather launched Portfolio tracking, which was one of its big missing features. I've spoken with Parth Gulati, one of Gather's founders, to get a deeper insight into the latest update.

Gather pitches itself as a way to track and grow your wealth through a single, simple interface. It does this by connecting to your bank accounts, using secure CDR connections, to analyse your transactions and accounts.

From there, you can classify your transactions to get a better idea of where your money is going, as a way to control spending and optimise expenses.

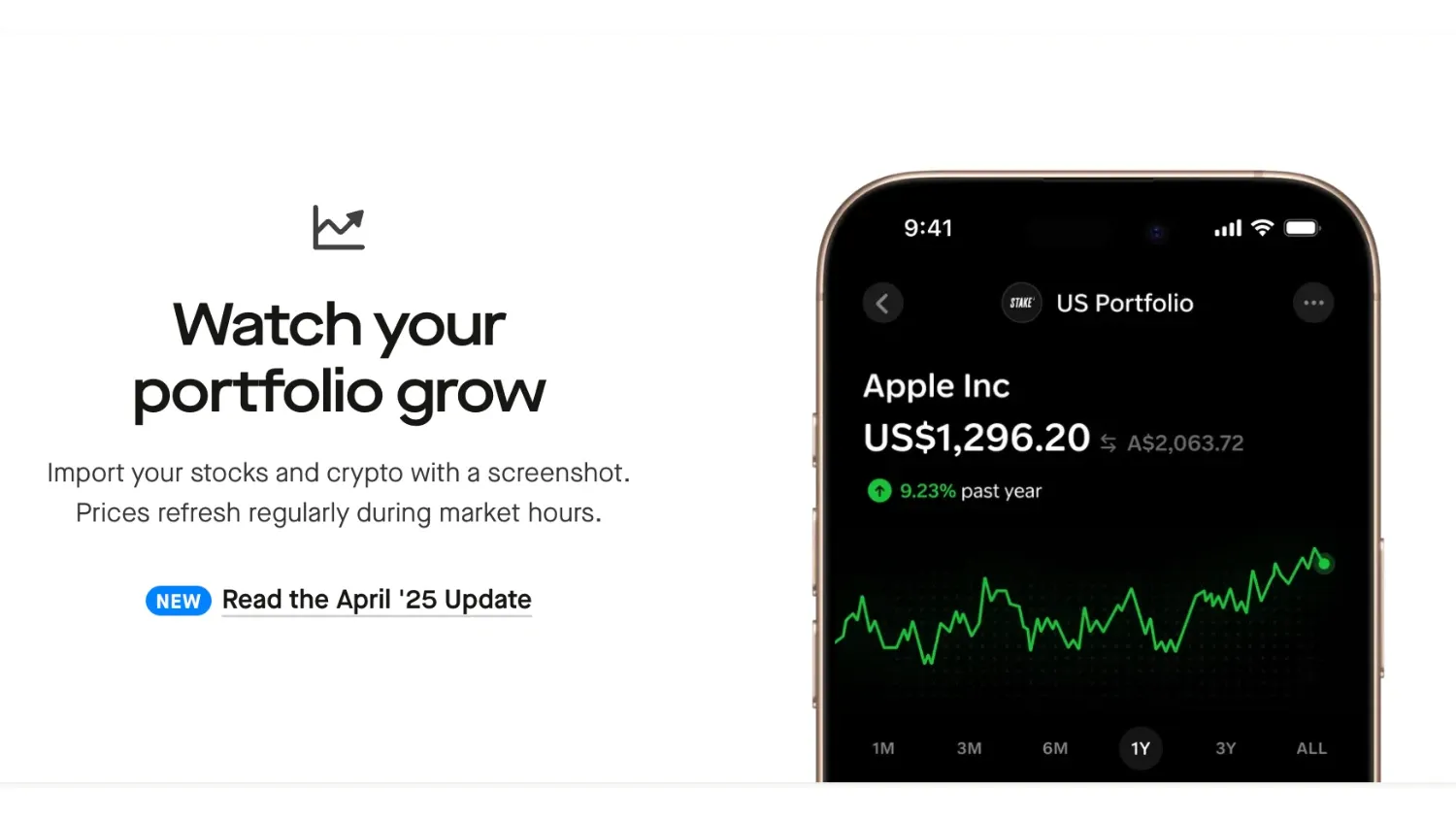

But a big part of growing wealth is investing, and this week's update addresses that need, in an interesting way. Rather than working with a third party platform, users can simply add their stocks or crypto holdings manually, or by uploading a screenshot of their holdings.

The app then scans it, matches it in its database, and sets up tracking automatically.

"The screenshot to import feature works every time as long as the exchange ticker of an investment and the number of units you own is clearly visible," explains Parth Gulati, co-founder of Gather.

"We use state of the art AI models to process this information to ensure accuracy. In the off chance it doesn’t work, you can manually add your investments."

You can track both Australian and US stocks, with values updated every 15-30 minutes during market hours, and automatic currency conversions so you know exactly how things stand at any given point in time. Global market support is coming soon.

"We chose this approach because unlike bank accounts and loans which are covered by Open Banking in Australia, stocks and crypto brokers and exchanges are not. And none of the brokers really have APIs, and where they do, they supply varying types of info with no set protocol," Gulati explained.

The new portfolio tracking joins existing features like tracking information from over 100+ banks, monitoring your property's value, tracking cashflow, spending and income, monitoring your energy bills for savings and keeping track of work deductions for tax time.

Currently Gather is still an invite-only experience, as the team at Gather works to build an app that solves a real problem for their customers.

That said, Gulati says that the app will be opening up to everyone in the coming weeks. And so far, the early response has been positive.

"We’re rated 4.7 on the App Store and 78% of our users report feeling less anxious about money after switching to Gather," Gulati explained.

BTTR relies on support from readers like you to keep going. If you'd like to support our work, consider a one-time donation. Every little bit helps us to cover costs and stay independent. 100% of donations go directly to authors. Thanks for your support!